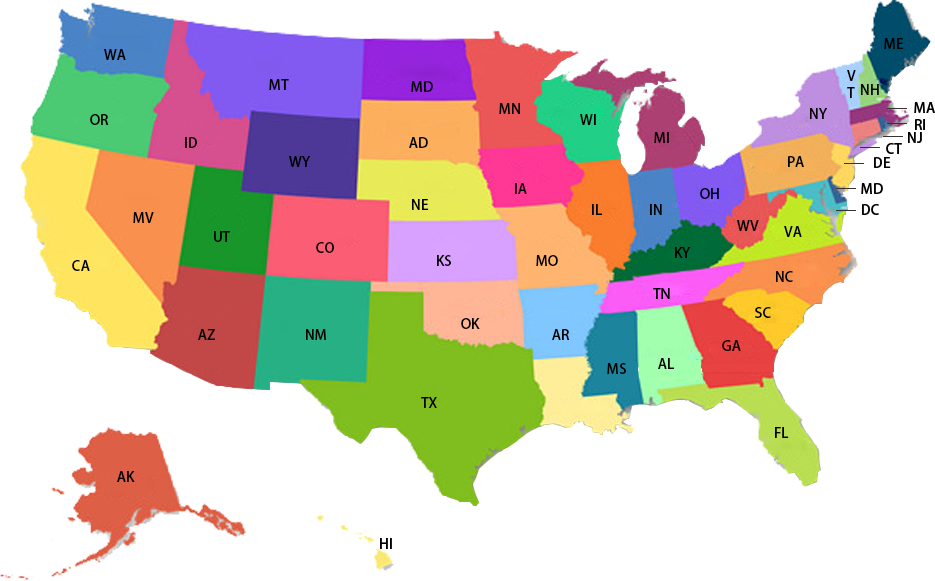

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- lllinois

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

There are two ways to qualify for a free cell phone from the government

You can qualify for a Lifeline cell phone and related services through participation in state or federal assistance programs. If you are on one of these programs you are already designated as a person that is in need of financial help so you don't need to prove this all over again. Here are the universal federal assistance programs in each state that will help you to qualify for the Lifeline program.

- Medicaid

- Food Stamps or SNAP through the Supplemental Nutrition Assistance Program

- Section 8 of the Federal Public Housing Assistance

- Veteran's Pension and Survivors Benefit

- BIA or Bureau of Indian Affairs General Assistance

- Tribal TANF Or Tribal Administered Temporary Assistance for Needy Families

- Tribal Head Start If you meet the income qualifying standards

- FDPIR or the Food Distribution Program on Indian Reservations

Each state will have an option to allow eligibility that is based on some of their own State assistance programs. For example in California, if you participate in the women, infants, and children program you can get a free cell phone. In Massachusetts, if you participate in the MassHealth program you can also qualify for assistance. If you don't qualify for any of the programs listed above please check your state to see if there are other programs that you might qualify.

The easy way to enroll in the lifeline assistance program is through participation in the programs listed above. If you can't qualify in that manner you can also enroll based upon the total income of your household. The household income must include all the income is received by each resident in the household. It doesn't matter whether this is taxable or non-taxable. It is including but not limited to dividends, interest, salaries, wages, child support, spousal support, gifts, grants, and allowances, inheritance, social security, public assistance payments, pensions, lottery winnings, rental income, cash payments from other sources, and self-employment.

The exceptions to this are military housing, student financial aid, cost-of-living allowances, or a regular income from small jobs. Small jobs would include lawn mowing, babysitting, and other small tasks.

All states besides California, Alaska, and Hawaii require income levels that are at or below 135 percent as indicated by the federal poverty guidelines. There is some conflicting documentation for this level in the states Michigan, Florida, New Jersey, and Texas. Some states indicate that it is 135% for the state while other states indicate its 150%. We were not able to verify this income. You will need to check with each provider to determine what the exact requirements are. If you are 65 years or older in the state of Vermont your household income may be as much as 234%. Please refer to the helpful chart below for more information on these rates ad check with the individual provider.

| PEOPLE IN HOUSEHOLD | ALL STATES EXCEPT: CA, HI, AK |

CA | HI | AK |

| 1 | $16,389 | $26,400 | $18,846 | $20,493 |

| 2 | $22,221 | $26,400 | $25,555 | $27,783 |

| 3 | $28,053 | $30,700 | $32,265 | $35,073 |

| 4 | $33,885 | $37,300 | $38,974 | $42,363 |

| 5 | $39,717 | $43,900 | $45,684 | $49,653 |

| 6 | $45,549 | $50,500 | $52,393 | $56,943 |

| 7 | $51,381 | $57,100 | $59,103 | $64,233 |

| 8 | $57,213 | $63,700 | $65,812 | $71,523 |

| For each additional person, add | $5,832 | $6,600 | $6,709 | $7,290 |

NOTES:

- You're only allowed one individual Lifeline account per household.

- You require a mailing address that is valid in the United States. You are not allowed to have a post office box because the cell phone has to be mailed to a valid street address and not a post office box.